Timeshares are based upon the idea of fractional ownership in a home. For example, if you acquire one week at a timeshare condo each year, you own 1/52nd part of the unit. If you buy one month, you own 1/12th of the system. Other purchasers buy the staying fractions. There are 2 basic plans: Deeded: You acquire an ownership interest in the property. Non-Deeded: You lease the right to use the home for a particular amount of time each year for a predetermined number of years. A timeshare is a type of fractional ownership in a home, typically in a resort or trip destination.

Timeshares need to not be considered financial investments, given that the vast bulk of timeshare agreements lose value in the secondary market and they do not create earnings for owners. From there, the numerous ownership structures become more complex. You can buy a fixed week, which means that you own the right to utilize the unit during the very same week each year, or you can buy a drifting week, which generally offers you the right to utilize the property during an established amount of time. Some properties run on a point system. These are frequently described as "getaway clubs." With these, you buy a specific variety of points that can be redeemed at a variety of locations.

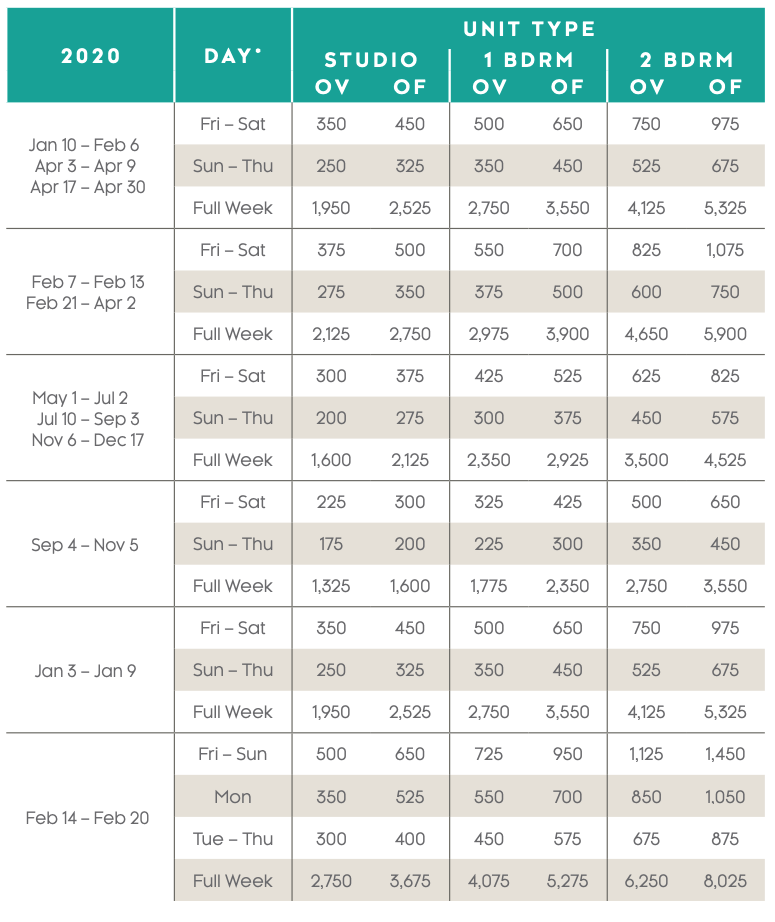

Cost varies by: Unit size Place Deed Brand name Time period acquired (e. g., December versus August at a ski resort) Timeshare properties can frequently feature bigger and more elegant accommodations than standard hotels and are normally located in desirable places. When you are standing in a beautiful condo ignoring the best beach and sparkling blue water, it is simple to give in to the sales pitch. Remember, timeshare salespeople remain in business selling your timeshare of selling. However just since they tell you that you are getting a lot, it doesn't mean that you really are. Before you purchase, take some time to research the property and speak with other timeshare owners.

Points-based systems featured no warranties. Just since the salesperson informs you it's easy to trade Visit this link your week for another week or your property for another residential or commercial property, does not mean it truly will be simple. If you own a week in Hawaii, would you want to trade it for a trip to the blistering hot Las Vegas desert in August? If you would not, chances are nobody else will either. It's also important to keep in mind that everyone wants to take a trip to the exact same locations and in the exact same weeks that you do. The desirability factor aside, trading often results in an additional cost.

Also, if the property requires a new roofing or a brand-new sewage line, a "one-time" assessment will be levied. Some properties likewise charge various charges, such as a publication charge if you want to view other homes that may be available for trade, and extra fees if they assist you sell your property. While a life time of trips sounds excellent, will the management business that sold you the timeshare be around three years from now? If you are considering a timeshare in a foreign nation, you need to also understand the laws and know what the result will be if the timeshare management company closes.

Who Can I Transfer Title In A Timeshare After An Owner Dies Fundamentals Explained

That condo on the ski slopes might look great today, however 5 years from now when you are a caring for an infant or are struggling with a herniated disk, your days on the slopes may be over, however the costs for the timeshare will continue. Think about that your desire to get on a plane may wane as fuel costs increase, airport security ends up being more onerous and the aging process makes you less tolerant of travel. A timeshare is not an financial investment. Investments are created to value in worth, produce income or do both. A timeshare is not likely to do either, despite what the salesperson states.

Hence, costing a revenue is an uphill struggle considering you need to persuade somebody to pay more for an utilized unit and element in all the charges you paid throughout the years. The very nature of the sales procedure ought to be a hint about the truth of the issue. Have you ever heard of a mutual fund, local bond or any other investment that provided you a complimentary weekend in Miami just for giving the item a try? A timeshare is not a financial investment, it's a holiday. It's likewise an illiquid asset that is most likely to decline with time - how to negotiate timeshare cancel.

If you do take the plunge, keep in mind that you are purchasing a repeatable getaway. Simply as spending $3,000 on a journey to an exotic beach is not an investment, neither is spending $10,000 plus upkeep fees on a timeshare. If you have discovered a getaway destination that you definitely enjoy and want to go back to every year and have decided that a timeshare is a best method to attain your objective, go ahead and purchase one. However purchase it used. Current owners that are tired of the upkeep costs, tired of the destination, or have grown annoyed with their efforts to trade their slot so that they can visit a different destination may want to give their timeshares away at a fraction of the original expense.

Purchasing used gives you all the advantages of ownership at the portion of the expense. Even if you pick a more pricey system, you can save cash by financing your purchase with an individual loan, which ought to use you a rate of interest that is considerably lower than the rate the timeshare business charged the original owner. Like any major purchase, the choice to buy into a timeshare requires careful factor to consider. It includes a big quantity of money in advance and significant recurring costs. You must ask plenty of questions and take https://www.ripoffreport.com/reports/wesley-financial-group-aka-westney-financial-group/baltimore-maryland-21202/wesley-financial-group-aka-westney-financial-group-this-is-a-scam-dont-send-them-mon-343551 your time making a decision - how to get rid of my timeshare. And as the Federal Trade Commission (FTC) says in its Customer Info: "The worth of these choices remains in their use as getaway locations, not as investments.".

Owning a piece of a villa sounds perfect, doesn't it? A place to call house and go to once again and again, knowing it's yours for a week or two. And you may consider buying a timeshare to make this dream a truth. Quick recap on timeshares: A timeshare is a villa split between folks who purchase into it for the right to utilize it once a year for a set time period. These individuals pay a lot of money upfront to guarantee their week every year to vacation in this timeshare place. However here's a little trick: You don't have to own a timeshare to use a timeshare! So, let's put timeshares on a time-out for a minute! They might seem like a great idea, however are timeshares really worth it? Are they worth all of your hard-earned cash and worth parting with much more of your cash year after year once you've gotten on board the timeshare train? No matter how you slice it, timeshares are not worth buying into.